Foster Parents are classed as self-employed. HMRC gives generous tax allowances to those who Foster.

Find out moreFoster Parent Pay and Allowances

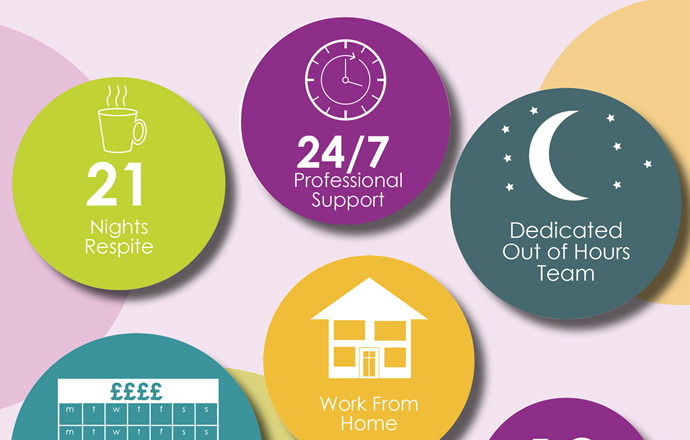

By the Bridge Foster Parents deserve to be rewarded for their hard work. Although we know it is impossible to place a monetary value on work that Foster Parents undertake on a day-to-day basis, our competitive allowances take into account the demands of Foster Parenting and the significant role a good Foster Parent makes on a child or young person’s life.

When a child is placed into Foster Care, the cost of caring for them is paid to a Foster Parent in the form of a Fostering allowance. This is made up of financial payments that cover the costs of caring for a child, plus a professional fee for their work. This enables Foster Parents to commit to Fostering as a full-time career.

Additional allowances for Foster Parents

You’ll also receive additional allowances to help towards all the added costs of looking after a young person, which can include: travel, clothing, equipment, and festive gifts - we know how expensive holidays can be, so to help you take family vacations together we also give you extras to help you with these extra costs too.

Fostering pay varies according to the type of Fostering you are approved for, the age of the child and their individual needs. The older the child or young person, the higher the Fostering professional fee and pay.

Typically a Foster Parent could earn from £24,000* a year, tax free, Fostering one child. That's the equivalent of a £29,440* taxed salary.

Career Progression & Promotion for Foster Parents

As you gain more experience as a Foster Parent you will have the opportunity to progress in your career and to higher pay grades.

If you have additional experience or training, you may wish to join our more specialist Fostering services (including Parent and Child Fostering; Fostering of children with complex needs and/or disabilities; or Fostering of sibling groups).

For more information or to ask any questions, please Contact Us.

*Based on a child in place for 52 weeks in a tax year