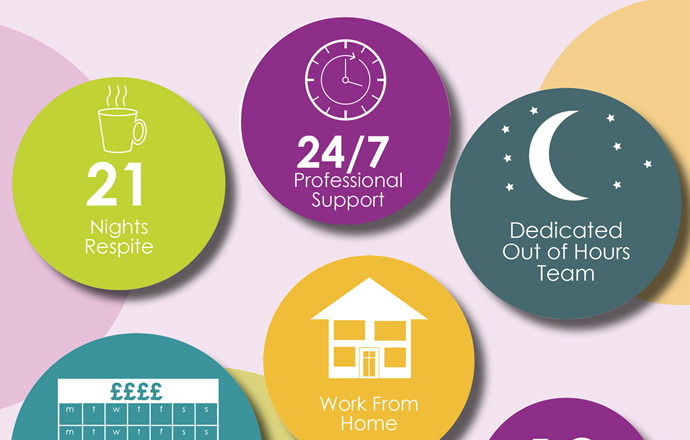

Fostering allows you to work from your own home and change the life of a child. We provide a range of financial and benefits to support our Foster Parents.

Find out moreDo Foster Parents pay tax?

The Government has generous tax allowances in place for those who foster, meaning that Foster Parents are usually exempt from paying tax on income derived solely from fostering. This specialist tax rule is known as 'qualifying care relief'.

Foster Parents are classed as self-employed so need to register as such and complete a tax return each year.

In addition to your individual tax allowance(s), as a self employed Foster Parent you’ll be able to claim:

- a tax exemption of up to £18,140 per household

- tax relief for every week a child is in your care:

- £375 per week per child under the age of 11 years old

- £450 per week per child aged 11 years old or over.

It is important to remember that each individual's financial circumstances are different. There are many elements that can affect your tax liability so it's best to check with the HMRC or speak to FosterTalk (as a By the Bridge Foster Parent you receive a complimentary membership to FosterTalk and access to their range of advice and helplines).

All figures based on 2023/2024 allowances.